Performance

Sep’22 was a tale of two extremes as the first half saw some strong upside followed by a sharp fall in the 2nd half. This was a result of the spillover from a melt down in global bond and FX markets as currencies weakened against the USD while yields rose sharply. The Bank of Japan intervened in the FX markets while the Bank of England had to shore up bond values or risk their pension plans facing collateral calls.

The Indian equity, bond and currency markets have been very resilient in comparison and the narrative of India being a bright spot in the world gained strength. At a sector level, Pharma & FMCG held up the best while Energy & Realty were worst hit in Sep’22. In the Jun-Sep qtr, Metals & FMCG were the standout performers while IT & Energy were the weakest.

Developments in trends we invest into in the ABC Portfolio

1. Manufacturing ecosystem – The news of Apple shifting a significant part of future I-phone production to India bolstered the case for Make in India. The govt. also announced divestment plans for some of its steel units.

2. Organized agri-business – Following up on the ‘one nation, one fertilizer’ policy, the Govt. is trying to popularize adoption of nano-fertilizers due to their cost efficiency and higher productivity.

3. Digital platforms – Trials for the ONDC platforms continue to be underway including plans for retail pilots in Bangalore soon. The telecom companies are also preparing ground for the planned roll-out of 5G services in Oct ‘22.

4.Supporting infrastructure – A Cabinet Committee approved the new land leasing policy for the Railways This can pave the way for divestments and encourage a shift of capacity to railways over time.

5.National Champions – There was news of the Govt. benchmarking share price performance of CPSEs with their sectors. The ability to periodically tap capital at attractive rates will be a necessity for future sector champions.

Summary & Outlook

The melt-down in currency and bond markets have exposed the vulnerability of the highly levered global private credit system, where sovereign bonds act as collateral. The panicky intervention by the BoE may have been a signal for central banks to slow the rate hike cycle. Inflation may however be stickier owing to geopolitics and a rewiring of supply chains. Hence the central banks have to walk a tight line which can lead to heightened market volatility.

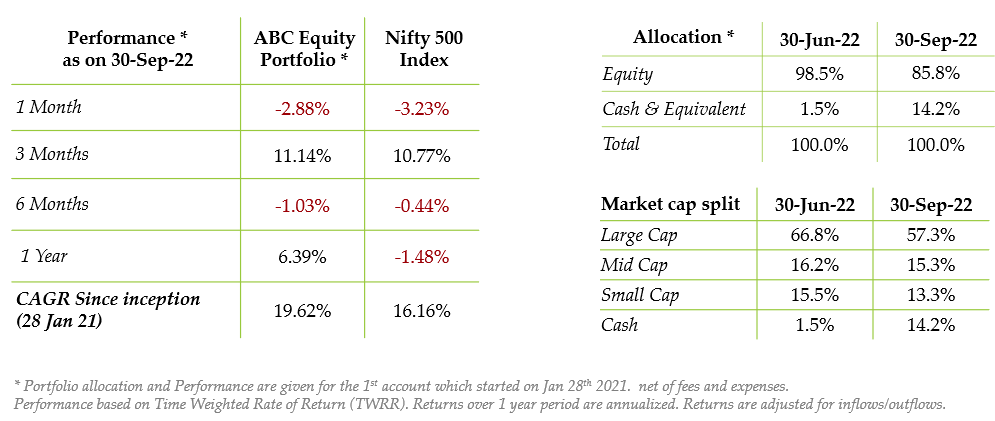

We used the exuberance in equity markets in the first half of Sep’22 to further raise cash to ~15% as FX and bond markets were already signaling red. This cash gives the optionality of redeploying at lower levels in our target themes.