ABC Portfolio - Oct '23 update

Investing in transformational trends in India as it transitions from a low income to a middle income economy

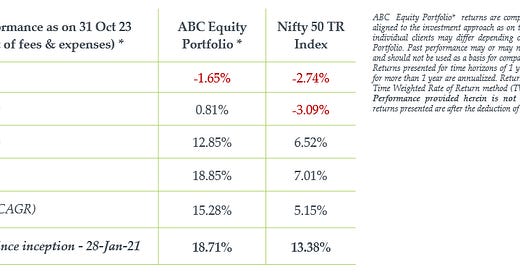

Performance

Oct ’23 saw falls continue in equities, bonds and currencies globally. The cuts were fairly uniform across major equity markets. The pace of increase in bond yields and USD slowed compared to Sep ‘23. Gold and Bitcoin defied the downtrend in other assets and rallied sharply towards 52 week highs.

Indian equity markets were in sync with the global weakness with midcaps being the worst hit, while small caps outperformed. Foreign (FPI) investors sold ~29000 cr / 3.5 bln$ of equities, while domestic institutional investors (DII) bought 25000 cr / 3 bln$, continuing the Aug & Sep ‘23 trend. Realty and State owned firms were the big gainers, while State owned banks and metals were the weakest. Indian bonds & INR moved in line with global trends.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. The Indian Electricity Grid Code, 2023 and General Network Access Regulations came into force in Oct ‘23, with a focus on grid security, integration of renewable energy and resource adequacy.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. Farmer Producers’ Organizations (FPOs) is a key initiative to solve the issue of fragmented holdings. They enable economies of scale for input purchases, technology adoption and marketing of produce.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. The Indian Railways is undergoing a multi-year transformation to cater to the expected growth in freight and passenger demand. This includes new rolling stock, engines, rail networks, freight corridors and electrification.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Infrastructure needed to double the share of natural gas in India’s energy basket is being evaluated. This includes city gas distribution, gas and petroleum pipelines.

Digital platforms – India’s digital public goods initiative enables interoperable public protocols on which private firms can offer products & services. Open Network for Digital Commerce (ONDC) - a protocol for open e-commerce, is expanding to enable financial services like credit, insurance & investments.

Summary & Outlook

While equities, bonds and FX continued to correct in Oct, the move up in Gold and Bitcoin reflected a break from recent trends. Normally, this would suggest rates have peaked and real rates will reduce from here. An alarmist interpretation is that they are acting as alternative reserve assets to the USD.

In India, FPI selling of equities (~6.3 bln$) in 2023 has been compensated by 18.7 bln$ of DII buying, reinforcing the growing power of domestic capital. The transition underway in India from a low to a middle income economy is a simpler journey compared to what’s needed in advanced economies.

The dichotomy between problematic global conditions but opportunities for India, makes us mix caution with aggression in our approach. The April to Sep buoyancy made us cautious over the past 2 months. Corrections or negative sentiments in markets, may make us more aggressive. The ABC Portfolio stays focused on India’s core needs to become a middle income economy.