ABC Portfolio - Nov '23 update

Investing in transformational trends in India as it transitions from a low income to a middle income economy

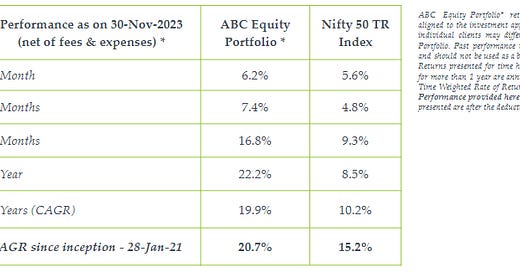

Performance

Nov ’23 saw a complete reversal of the Aug - Oct corrective trend as equities, bonds, currencies, precious metals and bitcoin rallied globally. A pause in rate hikes by the Fed and a geopolitical cooling off post the Biden - Xi meeting, were the likely triggers for the sharp fall in bond yields, crude oil & the USD. All major equity markets except China saw a sharp rally. Gold made a new high in USD terms and Bitcoin hit 52 week highs.

Indian equity markets were in sync with the global strength. Mid and Small caps continued to outperform. Foreign (FPI) investors were net buyers for the first time since July, while domestic institutions (DII) continued to be buyers. The rally was broad-based across sectors with Realty as the star performer while banks and consumer staples were the weakest. INR was an outlier which did not participate in the global rally of all currencies v/s the USD.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Critical initiatives being pushed for meeting India’s energy needs while using clean fuels, are the building the transmission grid to evacuate power from solar plants and using nuclear energy. Globally, there is a concerted attempt to secure critical mineral supply chains needed for the energy transition. The first auction for domestic exploration and mining of such materials is being conducted by the Indian government currently.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. Biofuels offers a path to help in our energy security while also offering agribusiness opportunities. Following norms on blending of ethanol in transport fuels, a similar initiative is on for mandatory blending of biogas into CNG for transport and piped gas for households.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. Building high speed rail corridors connecting India’s major cities is a key strategy to enable a multiplier effect on economic growth. The pace of infrastructure creation is driving infrastructure finance companies to grow their loan books rapidly and tap the bond markets for large fund raises.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Gas in seen as the transition fuel towards clean energy. Hence, initiatives are on to build strategic gas reserves and LNG import terminals and norms to blend biogas.

Digital platforms – India’s digital public goods initiative enables interoperable public protocols on which private firms can offer products & services. The RBI expects fintech lending to outpace traditional banking by 2030. It sees them as key to financing SMEs and for enabling cross border transactions. Efforts are on to have regulatory guidelines in place for these areas.

Summary & Outlook

The sharp rally in November across bonds, equities, currencies and gold have completely reversed the corrections seen since August. The fall in bond yields is being interpreted as signs of a recession, but equity markets or economic data don’t seem to be reflect such pessimism.

November was the first month since June when both DIIs & FPIs were net buyers of Indian equities. 2023 has seen 5.7 bln$ of net sales by FPIs being overrun by 20 bln$ of net purchases by DIIs. The removal of tax benefits for debt, real estate & insurance for domestic investors, has meant that few alternatives to equities exist for the highest income segments.

We had envisaged that corrections will likely be shallow given the above tax rule changes in Mar’23 and that’s how things have panned out in 2023. The Xi-Biden meeting and thawing of conflict have cooled off each side’s economic weapons i.e. USD & bond yields for the West and Oil prices for the East. This is an effective easing of conditions which is supportive of markets globally.

This ebb and flow of conflicts and varying financial conditions is a feature of wartime economics. This global transition is the defining trend of this decade and coincides with India’s own stage of evolution. In the ABC Portfolio we seek to benefit from these paradigm shifts with global and local tailwinds.