ABC Portfolio - Mar'22 update

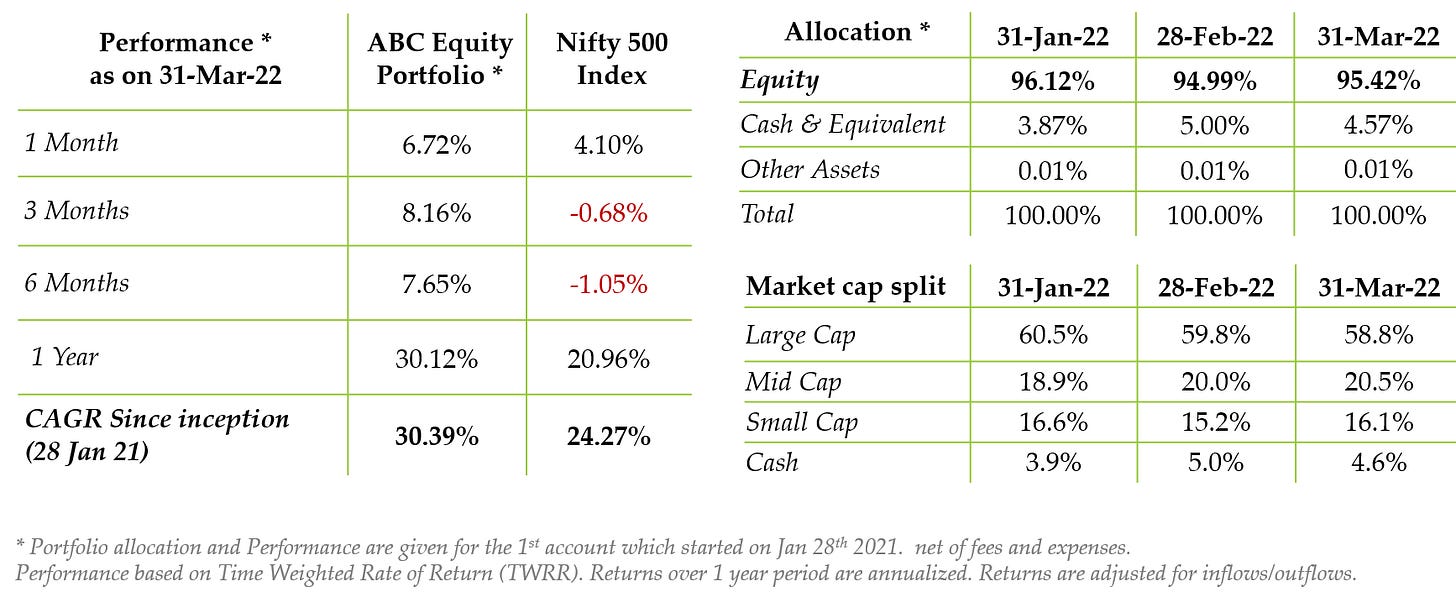

Performance & Portfolio updates - Mar’22

Mar’22 saw negative sentiment continue as the Ukraine war & Chinese lockdowns caused supply shortages in oil & gas, containers, fertilizers, wheat & metals. We saw a combination of rising USD, bond yields & commodities which is unusual and maybe signaling a regime shift. Despite the negativity, global equities halted the slide since mid Oct’21.

Indian equities & INR have been resilient through this phase despite large FII outflows & surging oil prices. While most sectors saw bounce backs, metals, energy and PSUs surged to new multi-year highs.

Developments in the trends we invest into in the ABC Portfolio

1. Manufacturing ecosystem - The combination of Covid & the Ukraine war has made it essential for every company to bring manufacturing capacity back on-shore. We participate in this global trend by investing in key input providers like energy, metals & automation. Current shortages have been beneficial for energy and metals.

2. Organized agri-business – The Ukraine war has created shortages in wheat and fertilizers. It will increase the fiscal burden on the Govt. and enhances the case for fertilizer sector reforms. The Govt. made statements about possible divestment or shutdowns in PSU fertilizer companies which led to strong price action in them.

3. Digital platforms – Blocking Russian banks from the SWIFT system is likely to accelerate cross-currency trades outside the USD using Central bank issued digital currencies. CBDCs are critical for linking various parts of digitized eco-systems and will accelerate the emergence of digital platforms.

4. Supporting infrastructure – as the roll-outs in manufacturing, agriculture and digitized eco-systems accelerate, building supporting logistics and infrastructure is critical and hence would see rising demand.

5. National champions – surging oil prices have pushed forward the energy transition process and PSU energy companies will have a large role to play.

Summary & Outlook – The events of the Jan-Mar’22 qtr. have strengthened the transformational trends we are investing into. Market volatility is to be expected in such times of global flux, and hopefully can be used in building our portfolios and generating returns.