ABC Portfolio - Mar '24 update

Investing in transformational trends core to India's transition from a low income to a middle income economy

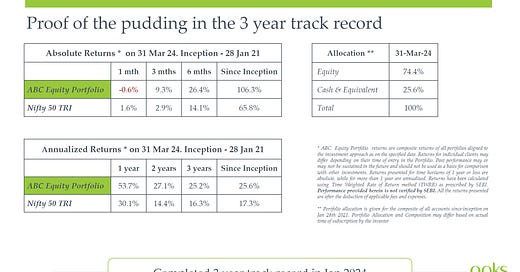

Performance

Mar ’24 saw strength across most major equity markets with Taiwan being the best and Brazil the weakest. Most currencies were weaker v/s the USD and bonds were down. Commodities were up strongly across oil, precious metals, industrial metals and agri, while the bitcoin rally stalled.

Indian equity markets were in line with global trends except small caps which were down sharply. March saw small buying of 3.3k cr (~0.4 bln$) by Foreign institutions (FPI) and the largest monthly buying by domestic institutions (DII) in the entire FY23-24. Sectoral returns showed considerable divergence with Metals being the best and IT services the weakest. The INR weakened in line with other currencies and bond yields also rose marginally.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Significant focus is being given on nuclear energy as a clean and reliable energy source via initiatives like small breeder reactors and private participation in financing. Building the transmission network to support renewable energy generation is another focus area. Attempts to secure critical minerals from South America are underway.

Organized agri-business – We capture this via the farm to fork supply chain & fertilizers. Prices of agri commodities like cocoa, coffee, palm oil and wheat have seen a sharp rise. We exited our position in a coffee plantation owner as it was bought out by its parent - a branded food processor, thereby changing the exposure to being a consumer rather than a producer of commodities.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. Infrastructure projects have been the cornerstone of the socio-economic and political strategy. Collective investment pools such as INVITs (Infrastructure REITs) and and fractional ownership of real estate via Small & Medium REITS (SM REITs) are likely be the mechanism to channel private financing to enable asset monetization post the development phase.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. The banks have been asked to create 3 year business plans for expanding the deposit base, resolving NPAs and improving cybersecurity. The oil marketers are expanding the EV charging network at their petrol pumps. Rising crude oil prices may bring back prospects of windfall taxes especially in this election quarter.

Digital platforms – We capture this via firms which use India’s digital public goods initiative as the foundation to offer products & services. The world has been swamped with Generative AI narratives. This is likely to be a massive productivity enhancement tools which will enable several “solopreneurs” and micro enterprises in the connected digital economy of the future.

Summary & Outlook

We saw commodities & bitcoin move up in a rising dollar regime. Equities also gained despite being obviously expensive while bonds fell. While this could just be momentum chasing, one should not discount the probability of markets sensing a structural shift towards assets as stores of value in a world when the denominator for pricing assets (i.e. fiat currencies) is devaluing.

The Bank of Japan exited its negative rate regime and talked about ending yield curve control, although in practice bond buying continued, causing the JPY to revisit its lows. This puts pressure on other exporter nations like Korea, China and Germany to weaken their currencies too.

China is restarting its manufacturing engine especially in EVs, which could lead to trade barriers in the US & EU. Given how much China has invested to build the EV supply chain, such barriers may be countered by a weaker Yuan, thereby triggering a competitive devaluation across currencies.

With India projecting itself as a manufacturing alternative to China, the RBI may have to participate in such a competitive devaluation should it happen. Read here for the likely impact of such a scenario for Indian equities.