Performance

The final performance across global equity indices for Mar’23 masked the intra-month volatility induced by multiple bank failures in the US & EU. Policy response in the form of bank mergers, liquidity for holdings & backstopping depositors led to a global equity and bond market rally in the 2nd half on the belief that it effectively ends QT.

Indian equity markets mirrored the global trend but continued their relative underperformance in 2023 as the focus for global & domestic investors was elsewhere. Indian bond and FX markets were relatively stable. IT & Auto were the weakest sectors, while Energy & Metals were the strongest in Mar’23.

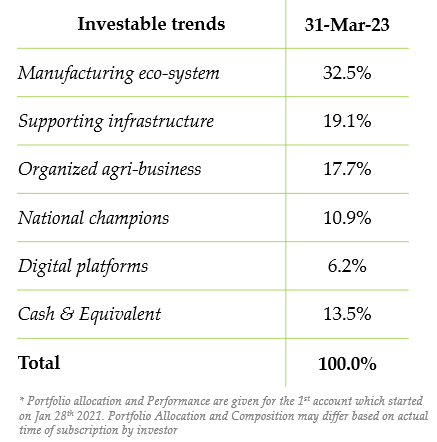

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. The Govt. has laid our a roadmap for increasing inter-state power transmission capacity - critical for RE power producers to sell to Industries. Several traditional auto firms and start-ups are looking to raise funds for EV roll-outs. Funding will accelerate EV manufacturing resulting in sustained demand for input metals.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. Scientific warehousing is integral to a modern agri-business supply chain. It creates market linkages leading to better production planning and allows farmers to sell over time to capture higher incomes.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate companies. PM Gati Shakti - a portal enabling complete project planning across Govt departments is at the core of all projects today. The alignment of economic, social and political benefits is visible as the pace of order flow and infra & logistics execution picks up across the country.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Oil & gas firms announced plans for downstream expansion into petrochemicals as well as upstream exploration efforts reflecting the policy direction for this sector.

Digital platforms – We capture this sector via digital platforms which can benefit from the implementation of IndiaStack. ChatGPT is creating an AI race, and global banking issues push forward the case for digital currencies & tokenized assets. These are building blocks of a future digital society.

Summary & Outlook

After maintaining a cautious stance from early Jan’23 till last week of Mar’23, we started increasing equity allocations and aim to continue doing so in Apr’23. The reasons for our incremental bullishness

- Globally, policy action post the US & EU bank failures i.e. guaranteeing deposits & liquidity against treasury holdings, negate the impact of QT. Hence the Dollar index went to new lows while gold & bitcoin rallied. These conditions are favorable for emerging markets generally.

- In India, removing the tax benefits on fixed income funds, insurance, real estate & MLDs will increase the attraction for equities. Recent corrections plus calculating P/Es on Apr’24 earnings will make markets look cheaper.

We continue to invest in the above themes focusing on India’s core needs for transitioning to a middle income economy.