ABC Portfolio - Jun '23 update

Investing in transformational trends in India as it transitions from a low income to a middle income economy

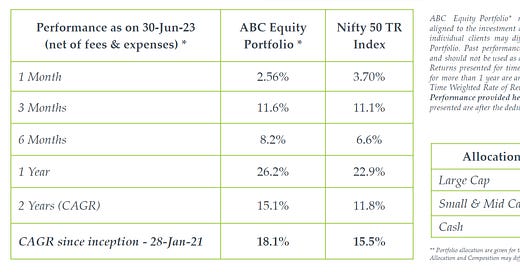

Performance

Jun ’23 continued to be a mixed bag across global markets. Equity markets were strong globally, post the Fed rate pause with Japan and Brazil being the best while Korea and UK were in the red. On the other hand, bond yields globally were close to their 2022 highs and the Japanese Yen and Chinese Yuan were weakest v/s the US$.

Indian equity markets were buoyant with small and midcaps outperforming large caps as net buying by foreign investors (FPIs) in June matched the ~INR 28000 cr (~3.4 bln$) buying in May. Pharma, Auto & Realty were the strongest reflecting higher discretionary spends, while IT services was subdued. Indian bond yields moved up gradually reflecting global trends.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. The joint declaration by the US & India for a strategic partnership across manufacturing, electronics, defense, energy transition and critical minerals is core to building a manufacturing ecosystem in India. The backdrop of geopolitics gives this initiative an urgency and continuity which will go beyond the existing political dispensations in either nation.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. Uncertainty regarding the onset of monsoons along with the prospect of El Nino was a key feature of this month due to its impact on the Indian agricultural landscape. These worries have likely eased by June end as the monsoons finally advanced nationwide.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate companies. Critical infrastructure gaps in proposed industrial corridors are being analyzed and roadways, railways and urban connectivity plans will be prepared. Real estate is benefitting from improving connectivity and urban infrastructure across India as end users drive purchases.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Rights issues are being planned for the state owned oil & gas which would enable the Govt. to add capital to these companies. This will be used to meet capex requirements from these firms to meet India’s energy transition goals.

Digital platforms – We capture this sector via digital platforms which can benefit from the implementation of IndiaStack - a set of protocols for digital public goods i.e. interoperable public architecture on which multiple private parties can plug in and operate. ONDC - the digital marketplace - continues to see adoption in local commerce and could disrupt existing platforms. RBI is expanding pilot projects of CBDCs and terming it as the future of money.

Summary & Outlook

The pendulum has swung from apathy and oversold markets in Feb-Mar to broad-based participation and vertical moves in many stocks in May - June.

- Conditions in fixed income and currency markets appear to be turning sanguine v/s the buoyancy in equity markets. Rising yields and US$ suggests a slow tightening process. The weakening in the Yen and Yuan can import deflation globally or be an instrument of geopolitics.

- Volatility is extremely low in equities which is supportive of the bullish moves daily across markets. However volatility in FX and bond markets may start inching up as 2022 highs are reached.

- The price action in the INR has not been commensurate with the scale of FPI inflows in the April to June quarter. This suggests that any break of the Yuan to new lows will likely see a similar depreciation in the INR.

Keeping this dichotomy of indications between equity markets v/s FX & bond markets in mind, we have kept our cash levels on the slightly higher side and may increase it further in case volatility spikes start appearing.