ABC Portfolio - Jul '23 update

Investing in transformational trends in India as it transitions from a low income to a middle income economy

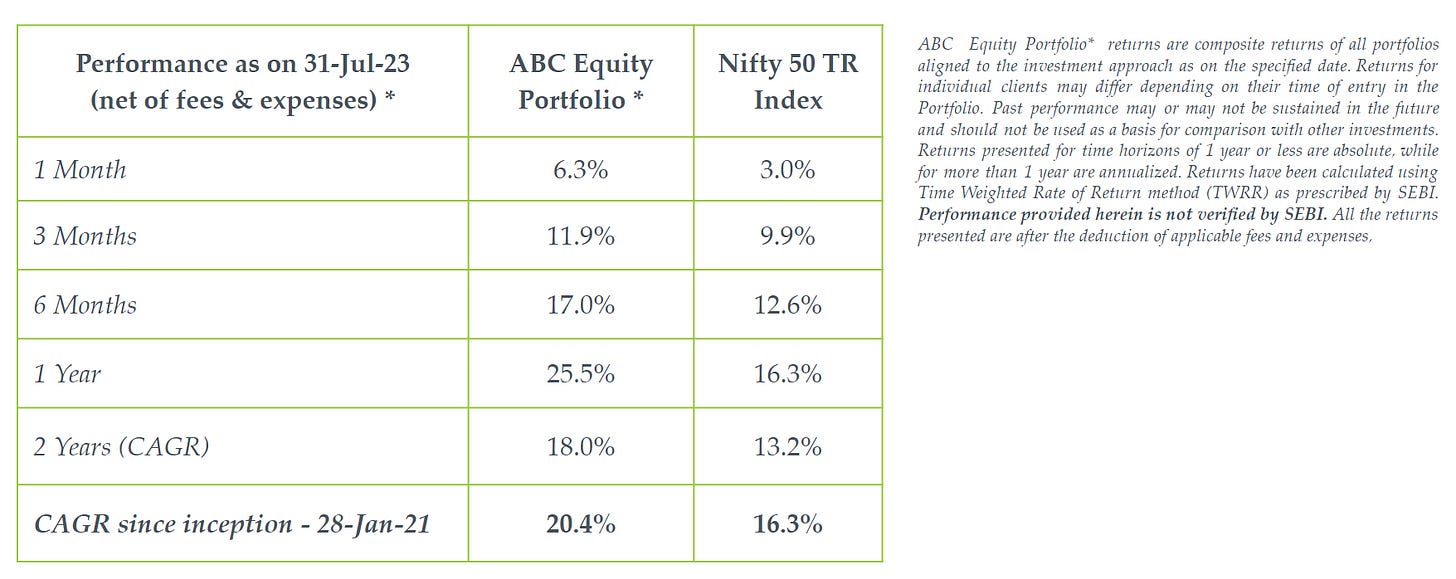

Performance

Jul ’23 saw signs of divergence between asset classes. Equity markets were strong globally, with Chinese indices seeing a sharp bounce. Commodities also followed the equity rally. Bond yields and the US$ rose steadily especially in the 2nd half of July suggesting tightening in financial conditions.

Indian equity markets continued to see outperformance of small and midcaps over large caps. Net buying by foreign investors (FPIs) in July was ~13000 cr (1.6 bln$) which is half the May and June flows. Media, PSU banks, Realty and Metals were the strongest sectors while IT services and FMCG were subdued. Indian bond yields moved up gradually reflecting global trends. The INR has been flat since May despite strong FPI inflows suggesting sterilization by RBI.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Energy transition is the key agenda and investments in renewable power generation (solar, wind, nuclear, hydel and biofuels), gas grids and interstate transmission lines are being finalized. Critical minerals needed for the energy transition are another focus area and plans for mining and refining are on the anvil.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. The government is trying to end import dependency for urea by 2025 via a combination of increasing urea production capacity and promoting usage of alternate fertilizers.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate companies. The government is prioritizing infrastructure spending on railways and roadways. Investments in signaling, track protection, high speed trains, freight corridors and station modernization are being done. The target for highway construction is being revised to 14,000 km in FY24 from 12,500 km set earlier in the year.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Cheaper Russian oil has enabled oil & gas firms to post large profits in the past quarter. Profits plus the proceeds from upcoming rights issuances will help finance capex for energy transition and downstream expansion into petrochemicals.

Digital platforms – We capture this sector via digital platforms which can benefit from the implementation of IndiaStack - a set of protocols for digital public goods i.e. interoperable public architecture on which multiple private parties can plug in and operate. India is attempting to take this expertise to other emerging markets. Creating digital payment linkages outside India for spending by Indian tourists abroad and for remitting money to India is high on the government’s agenda.

Summary & Outlook

So far, Indian bond and currency markets have been benign, giving a boost to equities. In July, central banks shifted to a data dependent approach which can induce greater uncertainty and volatility in markets.

Allocations from high net worth investors to equities has increased post removal of tax benefits on large ticket debt, insurance and real estate. This follows an 18 month period since Oct’21 wherein flows from this segment were tepid. Thus any correction in equity markets is likely to be bought into.

Quarterly results suggest weakness in consumption, higher levels of personal loans, weakness in exports and strength in domestic core sector activity. This ties in with our thesis that core sector capacity building is needed for mass job creation which in turn boosts per capita income and consumption.