Performance

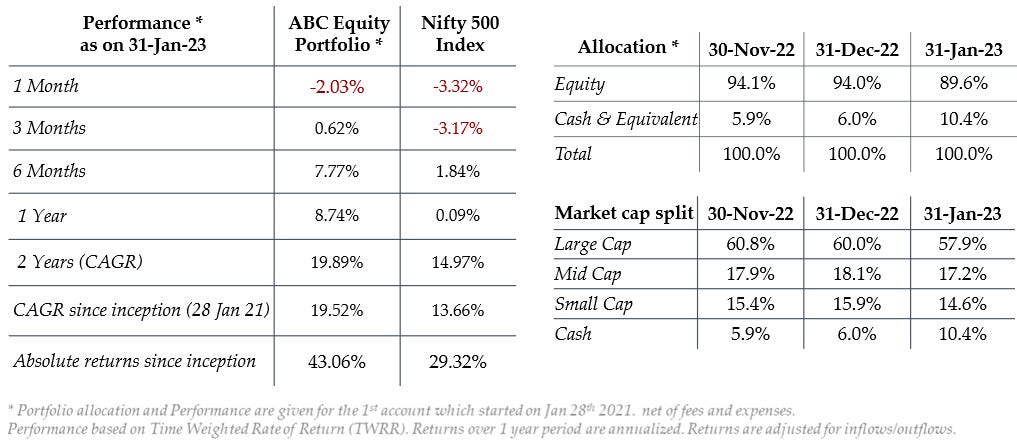

We completed the first 2 years of our journey in the ABC Portfolio by Jan ’23. This period has seen it all - bearish, bullish, volatile and flat phases. We managed to navigate it successfully following a top-down macro driven approach which isn’t common among Indian asset managers. Given the scale of global macro changes afoot in this decade - supply chain reset, energy transition and possible alt. reserve currency baskets - macro driven thinking will be essential in the investment toolkit.

Jan ’23 saw a continuation of the mean reversion trend where the beaten down markets of 2022 - Nasdaq, Korea & Taiwan were the best performers while India was amongst the worst. The valuation disparity was the initial catalyst and uncertainties around the Union budget plus the travails of a conglomerate may have added to it. Auto & IT were the standout sectors while the rest were weak with Energy, PSU banks & Metals being the worst.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – The policy push towards indigenization of the manufacturing continued with the Govt. asking leading business gps. for roadmaps on the same. Drone manufacturing partnerships in collaboration with US firms were set up. India’s 4 pt. energy security strategy - diversify imports, biofuels, domestic E&P and gas + green hydrogen were articulated.

Organized agri-business – A national fertilizer policy is being worked on for reducing import dependency. Raw material sourcing deals are also underway with multiple nations. The Green Hydrogen policy also laid out a roadmap for usage of of green hydrogen in ammonia production which goes into fertilizer manufacturing. Efforts to improve the FCI storage facilities are also underway.

Supporting infrastructure – The Union budget re-emphasized infra building as the way to create social upliftment instead of populist measures. Several major road projects are due for commissioning over the next year. Large orders for locomotives, coaches & tracks are being given to enable the road to rail logistics shift in coming years. Large real estate firms are actively pursuing the urbanization agenda with continued launches.

National Champions – The state owned oil marketing firms have had a favorable environment to partially recoup losses from subsidizing fuels. They may also receive additional govt. support to finance energy transition initiatives.

Digital platforms – The economic survey highlighted the benefits of CBDC for fostering financial inclusion, cross border payments and rapid innovation. India’s largest retail chain announced plans for accepting CBDC payments - a first step for commercial use cases. Linking CBDC’s to use cases will fill the gap which crypto has been unable to.

Summary & Outlook

We increased cash levels in mid Jan’23 given a less favorable risk reward from a global & local perspective. The rally in global equities has coincided with a weaker USD, which increases the probability of a trend reversal. India’s relatively higher valuations and 2022 outperformance v/s Asian peers is driving incremental flows towards those markets. Domestically as well, higher fixed income rates are now creating a higher hurdle for equity.

Risk free rates globally (~5%) and in India (~7.5%) translate into a fair value P/E range of 15 to 20x for equity markets. Investors are likely to be more attracted near the lower end of that band. In the ABC Portfolio we vary our equity allocation (between 80% to 100%) based on relative attractiveness.