As we closed out Jan 2022, we also finished the first year for the ABC Portfolio.

We navigated the post Oct’21 volatility well and used the market corrections in the 2nd half of Jan’22 to increase our equity allocation to a new high.

A quick background on the ABC Portfolio

A –Absolute Return in orientation

B – Basic in approach of selecting key trends

C – Concentrated in portfolio construction

We invest around key transformative trends which are currently undervalued / under-owned (in major benchmarks and diversified funds).

We capture the trends via a concentrated portfolio of ~15 stocks, managed with an absolute return orientation and customized as per the time of subscription.

We avoid popular sectors like private banks, insurers, IT services, consumer durables, autos, pharma & chemicals which are 75-80% of most index / diversified fund portfolios, and can be easily accessed via cheap beta options.

We use a macro driven approach to identify trends & the ways to capture them.

Mega trend we capture in the ABC Portfolio –> India’s transition from a low income to a middle-income economy will need a higher investment / GDP ratio

We structure the portfolio around the mega-trend of India making a shift from a consumer & services driven economy to a more investment led economy with multiple drivers in the coming decade. Many nations have gone through this shift when transitioning from a low income to middle income economy. e.g., US in 50s-60s, Korea in 70s-90s. China post 80s.

We convert this mega-trend into 3 investable trends to build the portfolio. Each trend has further sub-trends that enable multiple investment opportunities.

Objective of the investment push (in the economy) - to create mass scale, low to medium skill jobs (& entrepreneurs who can offer those jobs)

Financing of the investments – as the initial investment push will be from the Govt, we look at the various ways for them to raise finances

Medium of financing - financing the investments will require the development of a robust capital markets eco-system, benefitting the players in it

Composition of the portfolio (as of 31st Jan’22 for the first account)

Why did we take our equity allocation to its highest since inception?

A. WHAT THE MARKETS MAYBE MISSING IN THE FEAR OVER RATE HIKES & QUANTITATIVE TIGHTENING

The past 3 months has seen fear over the impact of Central bank (CB) rate hikes and potential quantitative tightening (QT), leading to periodic downdrafts in equity markets, with the new age / profit-less growth companies bearing the brunt of the pain.

We believe that tapering or QT is not necessarily tightening, as the potential expansion of commercial bank balance sheets is being ignored.

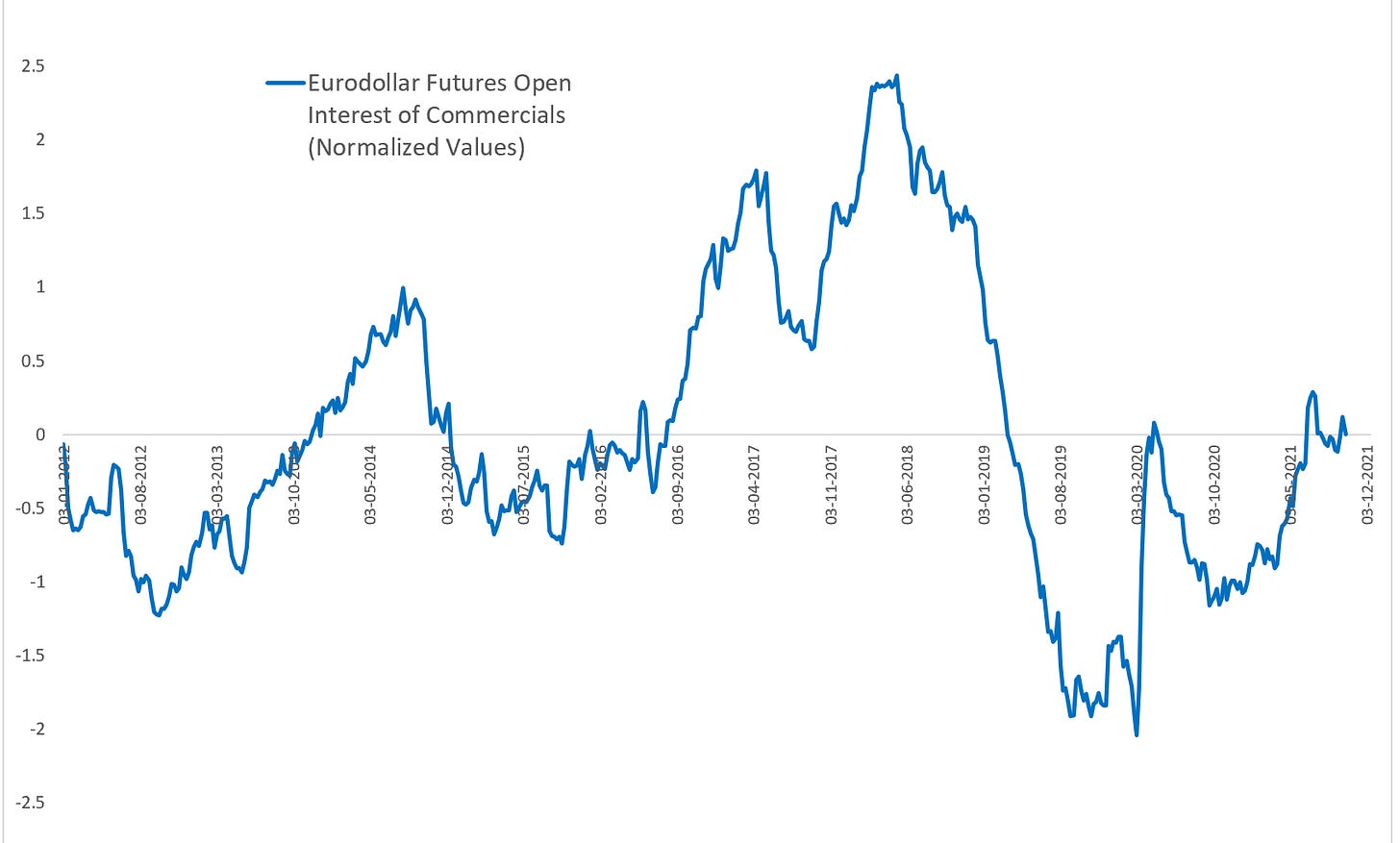

We measure commercial bank balance sheet activity via the open interest of Commercials in Eurodollar futures – the most liquid interest rate futures market a.k.a. the money pit. When banks expand their balance sheets, they hedge their interest rate exposures in the Eurodollar futures market thus increasing open interest.

The graph below of Eurodollar Futures OI of Commercials shows that commercial banks have only got back to neutral levels of balance sheet activity post the deleveraging since 2018. As the commercial banking system extends more credit (whether for financial market speculation or real economy loans), global liquidity and activity will increase.

The relevance - Commercial bank balance sheets maybe 10x of CB balance sheets (or 50x if you add derivative exposures) and hence can over-ride QT.

B. CONSENSUS BULLISHNESS ON THE US DOLLAR AND UNDERWEIGHT EMERGING MARKET EQUITY, BONDS & FX

There is overwhelming consensus for a stronger USD and an underweight on EM based on fears of potential outflows from them when the Fed tightens. This is in complete contrast to consensus positioning of a weak US dollar and bullish EM in the beginning of 2021, while the reality worked out to be exactly opposite of that.

A strong dollar hurts US exporters and chances are lobbying pressure would be building to weaken the same. A weaker Euro makes the impact of inflation worse in Europe and invokes fears of Weimar hyperinflation in Germany. The Euro is 56% of the DXY Index and any reversal of the weakening trend could set of similar actions in other currencies too v/s the USD.

A weaker USD can be a powerful tailwind for global credit expansion as the carry on FX & assets especially in high yielding EMs becomes very attractive.

If investors are also under-weight Emerging Markets, then it makes for a potentially bullish combination and hence our increasing equity allocations.

Activity in the ABC portfolio in Jan’22

We used the corrections in Jan’22 to add especially to the metals & mining space, thereby raising the allocation to the sub-trend which captures the manufacturing eco-system’s growth. This is in line with what we had written in our Dec’21 update as well.

To recap – we stopped adding metals & mining in April-May’21 when commodity prices and shipping rates got overheated. We re-started adding those names in the portfolio in Oct-Dec’21 and accelerated purchases in Jan’22.

The global tailwind for commodities in this decade comes from both financial and real economic demand plus constraints on supply.

Financial repression to inflate away debts

=> Allocation shift from FI to Commodities

Infrastructure building initiatives globally

=> Demand for ferrous metals

Digitization leads to higher electrification

=> Demand for non-ferrous metals

Supply constrained due to ESG considerations

=> Mine owners return capital or pay dividends v/s doing more capex

The cyclicality of commodity prices can be exploited in the portfolio while maintaining an overall bullish outlook on the space. A weakening USD (should it happen) can further support commodity prices.

In conclusion

The ABC Portfolio strategy focuses on the role of investments in driving India’s transformation from a low income to a middle income nation. This is in complete alignment with the India’s policy framework presented in the Union Budget, which is focused around growth via capex and technology adoption.

India’s transition is a part of a set of global trends focused on the supply chain reset, energy transition, agricultural productivity via technology, building infrastructure, industry 4.0 and the circular economy.

These global trends are part of an attempted transition of highly leveraged global system towards higher growth and escape from dis-inflation. The circumstances make financial repression as the core global policy along with the balancing act needed to keep things from spiralling out of control.

These domestic and global factors plus the influence of technological advancements on them, serve as the guiding path for us. They help map out the evolution of India’s transition and allow us to shape our investment strategy around it.