The events of Feb ’22 likely mark an inflection point in the role of geopolitics on investments. After decades of peace and peacetime economies, we are likely to transition to Wartime economies in the coming months & years.

Before we dive into that - a quick update on the ABC Portfolio

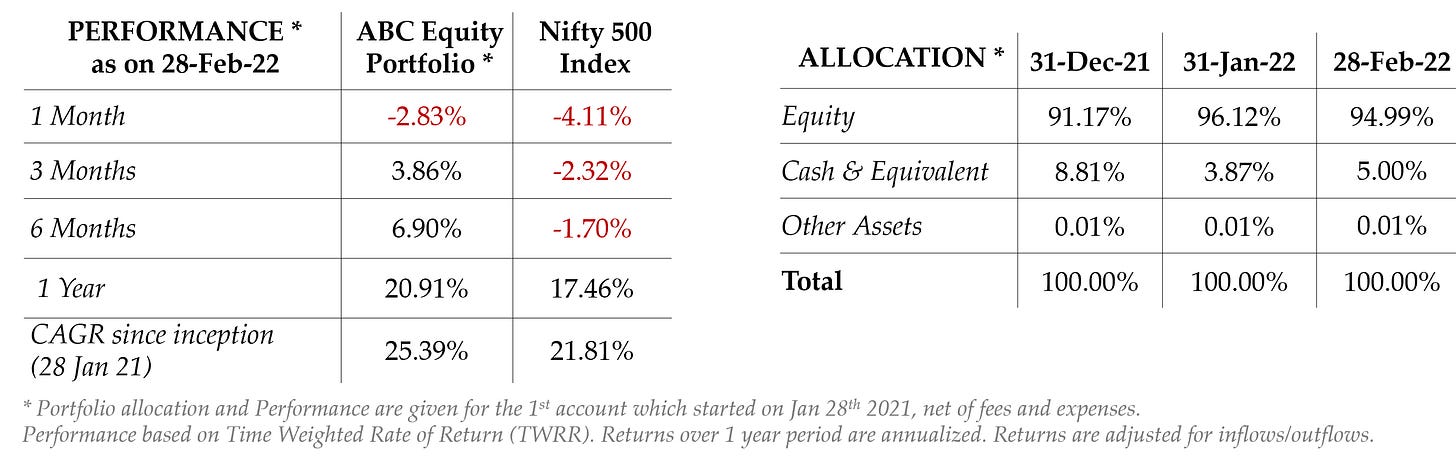

Performance & Portfolio updates - Feb’22

We navigated the market downsides relatively well. The equity allocation decreased marginally due to large dividends and a share buyback.

We invest with an absolute return orientation and use periods of market falls to buy while being relatively passive at other times. The portfolio remained similar to the Jan’22 when we completed the first year of the ABC Portfolio

The Ukraine conflict and why it marks a paradigm shift

We focus here on the actual actions of the various parties (as on 03-Mar-22) as opposed to an opinion on the reasoning behind the Russian invasion.

Western allied powers are not directly defending a non-NATO country

For the first time in history, the assets of a Central bank were blocked.

Excluding banks from the SWIFT network can set off a chain of defaults

Disruptions in supply will cause high prices & inflation

It is likely that this conflict is a first move in the US-China power struggle

These actions have the potential to alter the thinking of every nation around external dependencies - in defence, supply chains, materials and finance.

The implications of the ongoing conflict on India

The likely true nature of this conflict will mark a paradigm shift for India

In event of a likely two-front attack from China + Pakistan, we are unlikely to receive any direct military support from the US

We have significant external dependencies in many critical areas

Defence supplies from Russia

Fossil fuel based energy supply

Materials like Lithium, Cobalt needed for the energy transition

Fertilizers especially Phosphates & Potash.

Semiconductors and electronics

Blocking of Bank of Russia’s assets sets a precedent which could change risk management paradigms for central banks like RBI with surplus FX.

Weaponization of the SWIFT payment system exposes the risk of disruption of cross-border flows and trade.

Our vulnerabilities raise the probability of an opportunistic attack across multiple fronts (kinetic, cyber & psychological) by the regional hegemon.

Potential need for transformation to a “war economy”

The heightened threat perception will likely lead to a rewiring and scaling up of the economy on a war footing - i.e. a “war economy”

War economy is the organization of a country's production capacity and distribution during a time of conflict. Governments must choose how to allocate their country’s resources very carefully in order to achieve military victory while also meeting vital domestic consumer demands.

from Investopedia on “war economy”

(https://www.investopedia.com/terms/w/war-economy.asp)

The key focus areas for such a transformation would be

Reducing energy dependency by increasing Solar & Hydrogen capacities

Establishing domestic manufacturing eco-systems for critical items

Developing a digitized society interacting via digital currencies

Widening range of export items to increase demand for digital INR

Scaling infrastructure and logistics to support the above ambitions

Channelizing domestic savings towards financing of all the above

All this is exactly in line with the areas we focus on in the ABC Portfolio

We invest around India’s transition from a low income to a middle income economy driven by a higher investment push across manufacturing, real estate & infra, logistics, agriculture and digitized eco-systems.

What just changed is the need to implement the low income to middle income transition on a war footing given the geopolitical reality.