ABC Portfolio - Dec '23 update

Investing in transformational trends in India as it transitions from a low income to a middle income economy

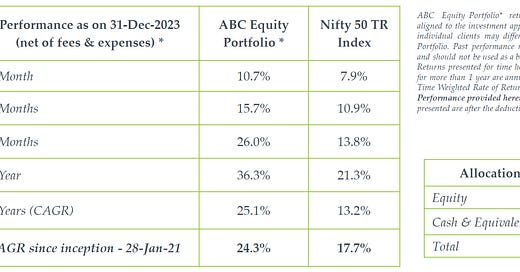

Performance

Dec ’23 saw the bull run continue across equity (ex China) and bond markets. Currencies, gold and bitcoin were flat while soft and hard commodities were slightly down. High expectations of multiple rate cuts by the Fed in 2024 was the driving force behind the buoyant sentiment.

Indian equity markets were one of the strongest globally courtesy buying worth 32k cr (~3.8 bln$) by Foreign institutions (FPI) and ~13k cr (~1.5 bln$) by domestic institutions (DII). Unlike the past few months, the larger cap indices outperformed with the Nifty Next 50 index being the strongest. The rally was broad-based across sectors with PSU’s, metals and energy performing best while consumer and auto stocks were relatively subdued. The INR and bonds were flat through the month as the RBI absorbed foreign inflows.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. COP28 in the 1st half of Dec meant energy transition initiatives were in focus. 21 firms bid for incentives to make electrolysers for green hydrogen production. Large transmission projects were sanctioned to evacuate power from solar projects. Talks were on globally to secure access to critical minerals needed for the energy transition. The interest in India as a manufacturing destination is building as reflected in a survey by the German Chamber of Commerce in China where 57.5% of firms wanted to invest here.

Organized agri-business – We capture this via the farm to fork supply chain, plantations & fertilizers. Norms for blending biogas in CNG for transport and piped gas for households were announced. Maize cultivation is being pushed for use in ethanol production. The states are being evaluated on multiple parameters to measure agricultural marketing reforms.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. The Vision 2047 document in the works detailing India’s path to development will lay emphasis on infrastructure creation. Large projects in multiple states are coming up for inauguration in the lead up to elections.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors. Activity is on across the oil & gas chain with oil production from the KG basin, LNG trading, building green ammonia capacities and sourcing oil supply outside OPEC.

Digital platforms – India’s digital public goods initiative enables interoperable public protocols on which private firms can offer products & services. Major consolidation is underway in the Indian media industry with popular OTT platforms being a core part of the discussion.

Summary & Outlook

December built on November’s rally as global markets sprinted to the year end on hopes of looser monetary conditions in 2024. The fall in bond yields created a favorable environment for leverage as collateral values rose. This was reflected in the strong performance across equities, bonds, gold, bitcoin and currency markets in the Oct - Dec quarter.

The end of 2023 presents a completely opposite picture for Indian equities v/s the end of 2022. A year back, global interest was higher in US and Chinese equities post the 2022 correction, while domestic investors were keen on fixed income. Hence investors were apathetic to Indian equities.

The rally post Mar’23 led by mid and small caps has seen large participation from Indian retail investors. Apathy has given way to buoyancy and reflected in the performance of market proxies likes exchanges and asset managers.

The sea shift in sentiment led us to reduce equity exposures across portfolios by end Dec. The expectation of multiple rate cuts has driven risk-appetite globally, but incidents like the Red Sea attacks can make inflation sticky and spoil the case for rapid rate cuts. The massive global changes underway e.g. rise of multipolarity, conflicts and supply chain reset, means that volatility in markets and sentiment is a given. (wartime economics)

We follow an absolute return orientation in the ABC Portfolio . We aim for excess returns by investing in core trends shaping India’s evolution from a low income to a middle income economy as opposed to buying the popular narratives of the last decade. At the same time, we use cash as a method to preserve capital during the interim troublesome periods.