ABC Equity Portfolio completes 3 years

Investing in trends core to India's transition from a low income to a middle income economy

We are delighted to have completed a 3 year track record for the ABC Equity Portfolio in Jan ‘24. This is accepted as a significant landmark in our industry as it gives enough datapoints to judge the quality of the portfolio strategy.

What made things doubly interesting is that we have seen a range of market conditions during the three years since Jan’21.

It was book - ended by bullish periods on either side i.e. Jan ‘21 to Oct ‘21 and Apr ‘23 to Jan ’24, which saw strong rallies and high investor interest.

In between was an 18 month drought with flatlining indices, periodic falls, bouts of fear, short rallies and phases of investor apathy.

This much variation implies that dissecting portfolio performance and seeing how we delivered v/s the original thesis should give useful results.

So let’s dive right in!

The original thesis back in Jan 2021

Our philosophy has always been to identify gaps in popular fund strategies when evaluated against the prevalent macro regime. Looking back to Jan’21

Majority had a bottom-up approach prioritizing stock selection

Large cap biased funds had sector allocations similar to the benchmark

An explosion in the number of mid / small / micro cap funds

Thematic funds get launched when themes are at peak acceptance

A general aversion to keeping cash and preferring to be fully invested

This made complete sense in 2010 to 2020 where monetary policy was the big driver with QE and low inflation. But all this changed with Covid.

The new macro regime triggered by Covid

Covid created the need for large fiscal stimuli globally as rates were already near zero. This resulted in debt levels becoming extraordinarily high across the developed world. The only way to reduce debt is via a policy of financial repression i.e. inflation runs higher than interest rates. This needs a mix of supply constraints and nominal GDP growth drivers - and that is exactly what government policies and geopolitics were delivering.

Covid and geopolitics highlighted the need for local supply chains

Rebuilding manufacturing and e-mobility needs electricity but renewable energy is far less efficient, while traditional energy is constrained.

Energy & supply chains are the bedrock of the dollar reserve system. Changing them alters the dynamics of the global financial system.

All the above could trigger a shift to a multipolar, deglobalizing one as the emerging superpower tries to reshape the existing world order.

This is a new macro regime where governments will play a large role in driving capital allocations to areas of strategic importance.

This formed the basis for the ABC Portfolio strategy back in 2021.

A - Absolute return orientation (seek growth but also preserve capital)

B - Invest in basic macro trends with domestic and global tailwinds.

C - Concentrated all-cap portfolio with a large cap bias

Top-down approach to allocate to sectors capturing macro trends

Ignore popular sectors of the previous regime (~75% of the index)

Take 3-4 months to deploy funds for a new account.

Mandate to keep upto 20% in cash for risk management.

Basic macro trends captured in the ABC Portfolio

India in 2021 was in a similar stage like ‘90s China or ‘70s Korea i.e. starting its transition from a low income to a middle income economy. Countries making this shift used a common playbook i.e. grow manufacturing, which leads to modernizing agriculture, building infra & logistics and developing real estate. This creates mass scale employment and hence grows per capita GDP.

The Indian government highlighted the same playbook in the Feb’21 budget. The reset of supply chains was the tailwind to kickstart India’s transition. It would happen in the digital age, which may bring some differences v/s past examples.

This led us to narrow down on the following portfolio themes

Building a manufacturing ecosystem in India

Converting agriculture into organized agri-business

Developing infrastructure to support GDP growth

Forging national champions in strategic sectors

Creating a digital society and digital economy

Don’t just play the game - play the player(s)

A particular macro regime provides tailwinds for certain sectors and their fortunes improve. Their popularity with investors rises and at the peak, they become a majority of the index. When the regime changes, another set of sectors get those tailwinds causing the entire process to rinse and repeat.

Let’s look at what we saw in India in early 2021.

As macro regimes changed from the 90’s dotcom era to the EM boom in the ‘00s to the QE era post ‘08, so did the popularity of sectors. This is measured by the shifts in their respective weights in the index as shown below.

Cross - referencing this table with sectors capturing our portfolio themes showed that they were largely in the neglected category in early 2021!

Converting theory to practice over the past 3 years

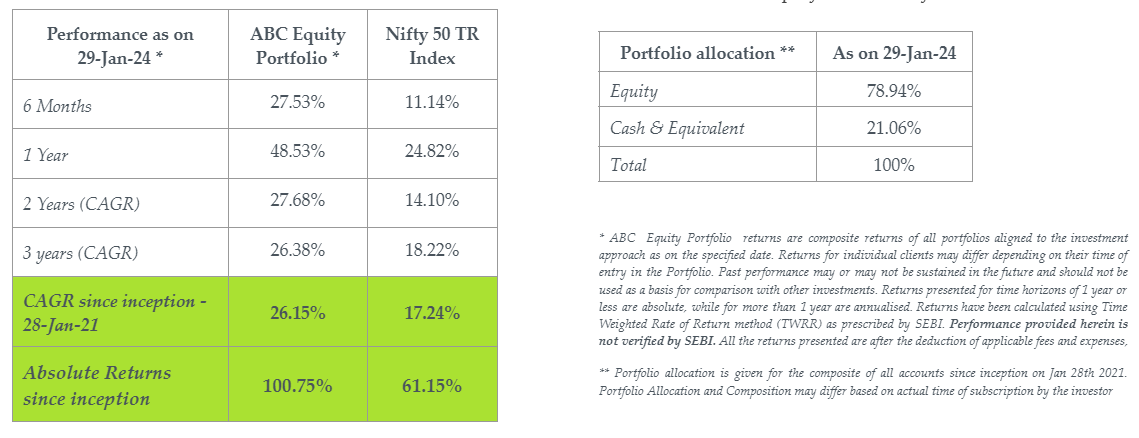

Composite portfolio performance (across all accounts net of fees and expenses) shows that we were able to generate significant alpha across time frames.

Dissecting into each calendar year and market phase (bull, bear, flat) shows consistency across periods, validating our absolute return orientation. i.e. generate returns in favorable periods and preserve capital in difficult times.

Attribution of returns based on market cap shows that it is possible to generate alpha by selecting the appropriate large cap names.

The decision on which sectors to allocate to and which ones to avoid was the biggest alpha generator and even compensated for the drag from cash.

Attribution of returns across market caps and sectors shows that an allocation driven approach can generate alpha from a large cap biased portfolio.

Looking ahead - the big picture

Notwithstanding the popular narrative within India (and outside recently), the mainstreaming of India in global financial markets is still in its infancy.

India is 1.77% of global equity indices and not part of global bond indices yet.

As originally envisaged, we saw a shift in relative weight of the popular & neglected sectors of 2021 over the past 3 years.

The mainstreaming of India or the development of the macro themes driving India’s income transition are still in their early stages, suggesting there is still a long way to go in the larger scheme of things.

But it will not be all sunshine and roses either.

When markets get priced for perfection, potential for trouble (from markets, geopolitics, earnings or policies) become non - zero probabilities.

The interplay between the popular narrative, the reality of delivery and the swings of sentiment serve up both risks and opportunities.