ABC Equity Portfolio - May '24 update

Investing in transformational trends core to India's transition from a low income to a middle income economy

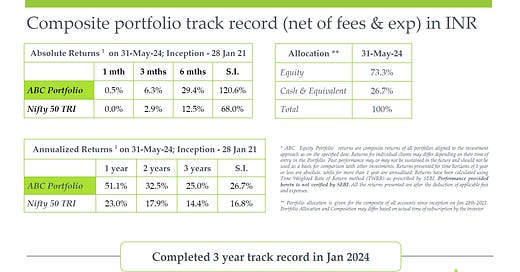

Performance

May’24 saw mixed trends across major equity markets with the Nasdaq and Taiwan being the strongest and Brazil being the weakest. Divergent trends were also seen in other asset classes too. DM FX was stronger while EM FX was weaker v/s USD. Bitcoin and Agri- commodities resumed their 2024 rally, while Gold, Metals and Oil consolidated. Bond yields softened in May.

Indian equity markets also diverged in May as the smaller large cap & mid cap indices were up while the large cap & small cap indices were down. Net sales of INR 42k cr (~5 bln$) by Foreign institutions (FPI) was absorbed by INR 56k cr (6.7 bln$) of buying by domestic institutions (DII) continuing the CY24 trend. Sectoral returns diverged with metals, PSUs and Auto being the strongest, while IT and Pharma were weak. The INR and Indian bond yields largely mirrored global trends.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Post elections, focus will be on India’s strategy for energy independence. This has many components - role of traditional fossil fuels like oil and coal; transition to a gas economy; renewable energy across solar, wind, hydel, nuclear and biofuels; green hydrogen initiatives; securing critical mineral supply chains; transforming power grids; securing financing and developing requisite technologies for the above.

Organized agri-business – We capture this via the farm to fork supply chain & fertilizers. The economic weakness and low job prospects in rural areas has been a big factor in the electoral reversals. Consequently, a renewed focus on the agricultural space is likely with policies to support production, exports, cutting fertilizer subsidy leakages and agrochemical manufacturing.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. Given the continuity in the government including the allocation of ministries, the focus on infrastructure & logistics is likely to resume. They have an essential role in both job creation and overall economic growth and enablement. This will need raising debt capital for project execution and transferring operating assets to free up capital for the next project.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors, and developing the life insurance sector. MSME’s will be a focus area for the banking sector given their role in mass job creation. In the oil & gas space, the discussion to bring petrol, diesel and natural gas under GST is gathering steam.

Digital platforms – We capture this via firms which use India’s digital public goods initiative as the foundation to offer products & services. This would require building Digital platforms via a convergence of technology, finance, ecommerce, energy and logistics. Companies will sharpen their development strategies via organic and inorganic means across these domains.

Summary & Outlook

May saw trepidation in the markets about the election verdict not being as favorable as expected - a fear that proved to be right. The results reinforced the need to create mass scale jobs given India’s current state. Irrespective of who is in power, growing core sectors which create these jobs is a necessity.

The path to grow these areas i.e. manufacturing, agriculture, infrastructure, real estate and logistics requires investments in hard assets, typically funded by a mix of debt and equity with ~70% being debt. Thus, India’s prospects of executing on its low income to middle income economic transition hinges on the attractiveness of its debt markets.

At a portfolio level, mindful of the growing enthusiasm for some of our ideas and the big event risk on elections, we maintained cash levels close to 20% (our maximum mandate) in our mature portfolios since the start of CY 24. As things stabilize, we will continue investing in our key themes as these trends play out over the next few years