ABC Equity Portfolio - June '24 update

Investing in transformational trends core to India's transition from a low income to a middle income economy

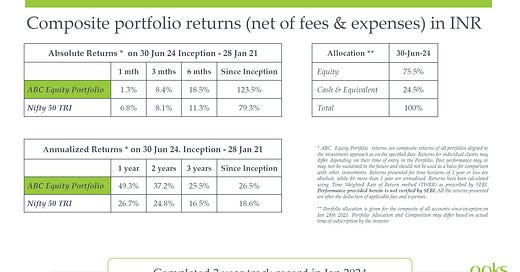

Performance

Jun’24 continued to see mixed trends across major equity markets with the US and Taiwan being strongest while China & EU were weak. Divergence was seen in other asset classes too. Bitcoin, Agri-commodities and Yen were weak while Gold, Oil, Metals and Bonds rallied.

Indian equity markets were among the strongest globally, post the sharp fall on election results day (4th June). The strength was seen across Large, Mid and Small Cap indices. Foreign institutions (FPI) were small buyers of INR 2k cr (~0.24 bln$) while domestic institutions (DII) bought INR 28.6k cr (3.4 bln$) Sectoral returns showed a strong reversal in June. Underperforming sectors of 2024 i.e. Private banks, IT services and Consumer saw a sharp rebound, while previously performing sectors like Metals, PSUs and Energy were laggards. The INR and Indian bond yields were flat through the month.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Investments of ~200bln$ would be needed to reach the 500GW renewable energy (RE) capacity by 2030. Additionally, ~160 bln$ needs to be invested in transmission, distribution and storage to support the RE capacity. Base metals and rare earths are critical for the energy transition. Discussions are on with Australia for partnering in sourcing and processing and with South American and African countries for stakes in mining blocks. The Center has taken over responsibility from the states for issuing domestic mining exploration rights, as the states are not resourced to execute on it.

Organized agri-business – We capture this via the farm to fork supply chain & fertilizers. With rural disenchantment being a big factor in electoral reversals, this area needs interventions. Agriculture & rural development coming under the same minister is a first step to synergizing policies for rural areas. A three pronged approach is needed involving creating non-farm jobs to reduce the number of people in agriculture; boosting high value agriculture (vegetables, fruits, poultry, dairy etc.) with market linkages to grow incomes and building resiliency against climate change and extreme weather events.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. The budget is likely to focus on infrastructure and logistics given its multiplier effect on growth and job creation. The allocation to railways will be used to create three economic corridors focusing on energy, minerals and cement transportation. Channeling long term capital from global sovereign and pension funds as well as domestic savings will be needed. Skilled workers to operate machines as well as unskilled workers are in short supply, implying focusing on skilling for infrastructure and logistics will boost jobs.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors, plus developing the life insurance sector. Meeting India’s energy needs to support economic growth will involve usage of oil, gas and renewables. Upstream investments, diversified sourcing, oil storage and refining are key. Green industrialization and green mobility become the drivers of policy. Corporates have relied on internal accruals thus far, but as private capex plans firm up, their demand for term loans and working capital from state owned banks will rise.

Digital platforms – We capture this via firms which use India’s digital public goods initiative as the foundation to offer products & services. This would require building Digital platforms via a convergence of technology, finance, ecommerce, energy and logistics. The ONDC protocol (Open network for digital commerce) is shaping up as the base layer on which buyers, sellers, credit appraisers, lenders and borrowers will come together in the digital economy. Pilot projects consumer purchases and lending are underway.

Summary & Outlook

June saw a strong rebound in India equity markets post the volatility around election results. After trailing Chinese equities (HSCEI Index) since the start of CY24, headline Indian indices did a catch-up in June. The move in June was led by the sectors which had been laggards earlier in the year.

The above table will give a visualization of this sector rotation. The 1st table has returns of sector indices for Jun’24, the 2nd table has returns for the Apr to Jun quarter and the 3rd table has returns for CY24 (Jan to Jun’24). Sectors shaded in green are exposures in our portfolio while those shaded in yellow are popular sectors of the last decade which we ignore, as an investor can access them via most funds.

Large sectors in the index like Private Banks, IT services & Consumption were big drivers of returns in June in contrast to their underperformance in CY24. Since we don’t own these sectors (easier to access them via an index fund), our portfolio underperformed significantly v/s the index in June due to this sector rotation.

In the previous 12 months building up to the elections, we had seen a lot of interest in our themes and sectors in expectation of favorable election results and policy drives. This meant some near term froth notwithstanding the longer term growth prospects. While this benefitted us greatly in terms of outperforming markets by a distance, it also meant we would be vulnerable to near term volatility, especially if election results did not pan out as expected. Such a scenario would likely prompt an outflow from sectors which rallied in anticipation and rotation into the old favorites which had been laggards.

Due to this reason, we had kept a significant amount of cash in our portfolios in the lead up to the elections. We did not buy aggressively in June either in anticipation of the above sector rotation.

We wanted to see a narrative shift from sectors we focus on back towards the old favorites, and this seems to have happened now. This gives a more favorable environment to scale back into some of our sector holdings.

At the same time, one is mindful of the potential risks given much higher level of valuations v/s Mar 2023 or June 2022 and much greater investor interest in markets v/s the apathetic periods of 2022 or early 2023.

The tax increases from Apr'23 in debt, structured notes, insurance, high value real estate and overseas investments has meant a lack of attractive investment options (on a post tax returns basis), making equities the only alternative for domestic savings. However, any tax changes to incentivize channeling of savings to fund infrastructure and capital investments could create those alternatives.