ABC Equity Portfolio - Aug '24 update

Investing in transformational trends core to India's transition from a low income to a middle income economy

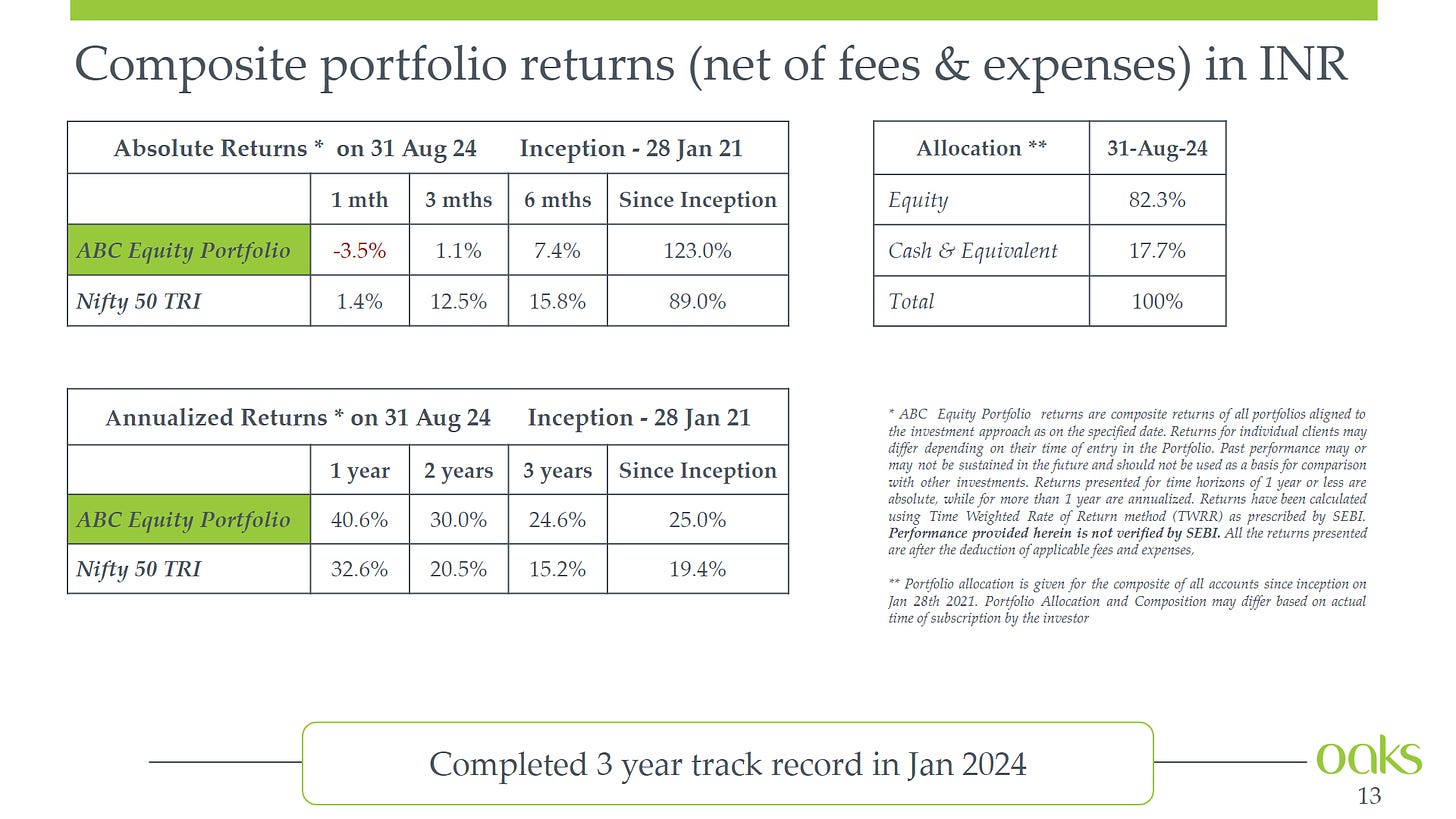

Performance

Aug’24 saw a strength across most equity markets with Chinese H-shares and Brazil being the strongest while US Small caps and Japan were weak. The Yen rally continued causing other major currencies to also rally against the USD. The commodity complex was a mixed bag with Gold and Agri rallying, Metals and Bitcoin were flat while Oil was down. Bond yields continued to be soft.

Indian equity markets participated in the global equity rally with Large caps being the driver while Mid caps lagged. Foreign institutions (FPI) were sellers of INR 20.3k cr (~2.44 bln$), but this was absorbed by INR 50.2k cr (~6 bln$) by domestic institutions (DII). At a sector level, Pharmaceuticals, IT services and Consumer continuing to drive the index while Realty & PSU banks were weak. Indian bond saw a rally in line with rate cut expectations while the INR did not participate in the global currency rally v/s the USD.

Developments in trends we invest into in the ABC Portfolio

Manufacturing ecosystem – We capture this via input providers like energy, materials & automation. Nuclear energy is being looked at as a key solution for reliable and clean energy with small reactors seen as the way to scale. Energy storage is another important area via batteries, pumped storage and gas fired generators. Cheap exports of steel from China and Vietnam is prompting the government evaluate imposition of duties.

Organized agri-business – We capture this via the farm to fork supply chain & fertilizers. With agriculture likely to be a focal point of India’s developmental process, several policy initiatives are being explored. A critical piece will be the effective use of digital public goods to collect actionable data throughout the agri ecosystem to enable scientific decision making and link production with markets. Ari export clusters are being planned in order to boost farm incomes and enable modernization of Indian agriculture.

Supporting infrastructure – We capture this via infrastructure, logistics and real estate. A cluster based approach is planned for industrial development in India. A proposal to set up 12 industrial townships across India was approved under the National Industrial Corridor Development Program. Three railway projects in the mineral rich eastern region are also being planned.

National Champions – We capture this by replicating the Chinese strategy of consolidating the state owned banking and oil & gas sectors, plus developing the life insurance sector. Banks are struggling to attract deposits which can impact the pace of credit creation. The state owned banks with more new to banking system customers from rural areas are relatively better positioned to face this challenge. The oil price correction is helping in the overall margins for the oil marketing and refining companies.

Digital platforms – We capture this via firms which use India’s digital public goods initiative as the foundation to offer products & services. The RBI will introduce the Unified Lending Interface (ULI) as the 3rd part of the financial technology stack comprising digital accounts, digital payments and digital lending. The objective of ULI is to simply credit appraisal and disbursement especially to smaller / rural borrowers and expand the financial ecosystem.

Summary & Outlook

August was a month which continued with the sector rotation seen post the June elections towards the old favorites like IT services, Consumer staples and discretionary, Healthcare and Private sector financials. At the same time, the core economy sectors we are invested in continued with their corrective action. This is in line with our expectation post the elections and continues to offer us opportunities to build the portfolio allocations for our new investors.

Long term trends will always have periodic corrective phases causing short term underperformance. However we see price action over the cycle with its periodic ebbs and flows. India began a new cycle since Covid with an investment led growth strategy. The elections were a important point forcing an evaluation of its effectiveness and some tweaks will be incorporated given the macro regime. The core elements are the same and it is what our portfolios are aligned with.